What we’re more concerned with and prepared to solve are the mechanics of why settlement on blockchain does not yet exist. In other words, the challenges inherent in blockchain that are roadblocks to making settlement a reality. These include:

- Pre-funding. Participants in a blockchain transfer are required to part with cash or assets in advance by pre-funding their transaction to mitigate counterparty credit and liquidity risks. This ensures a transfer is executed once the counterparties agree on the terms (i.e., price and amount). While this process does take advantage of blockchain automation, it’s far from the much-hyped instant settlement that some claim this supports

- Central bank digital currencies / stablecoins. To facilitate the instant transfer of funds, an interoperable central bank digital currency (CBDC) or stablecoin is needed. While there are many in the works from industry players, none currently exist.

- Delivery failures. On general-purpose blockchains, users are able to agree to a transfer without delivering the assets, or agree to multiple transfers with the same set of assets. This leads to greater counterparty risk, a lack of confidence in the technology, and general confusion. The solutions that do exist to solve this problem, like many solutions for general-purpose chains, come in the form of layer-2 fixes that drive up costs and reduce efficiencies. The right solution needs to build a framework with these considerations into the core of the chain.

Each of these challenges work as a roadblock to settlement on blockchain. And yet, with the opportunity to drive massive process improvements, the potential surrounding settlement on blockchain is staggering. Polymesh proposes a framework to facilitate settlement on blockchain, one that aims to mimic the traditional market approaches and pairs them with the benefits of blockchain, unlocking a potential path to instant settlement.

The Polymesh Approach

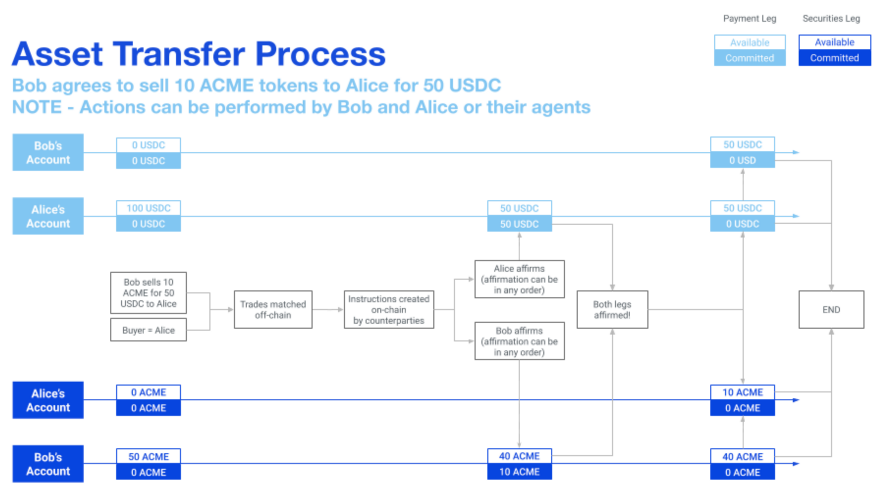

The Polymesh blockchain addresses the roadblocks to settlement through its unique, protocol-level asset transfer process that removes both the delivery failure problem and the need to pre-fund. While this is only two of the three challenges listed above, Polymesh makes the integration of a CBDC or stablecoin seamless for when they are available.

Above: An example of asset transfers on Polymesh.

How it works

The inner workings of asset transfer reconciliation can be complicated, which is why much of it happens under the hood. For users, this means a simplified approach to transfers that relies on efficient workflows and blockchain automation. For users, the process is simple:

- Seller and buyer agree to terms (i.e. price and quantity) on an external venue. This can happen through primary issuance, matching on an external venue like an exchange, a P2P over-the-counter agreement, etc.

- The terms of the transfer are input (as an instruction) by the buyer and seller

- Both the buyer and seller affirm the transfer. Once affirmed, the assets are committed and cannot be spent in another transfer. Committed assets solve both the delivery failure and pre-funding problems without the holder relinquishing control of their assets: they cannot be spent in other transactions, and assets do not need to be sent away in advanced preparation of a potential transfer that does not yet exist.

- The compliance rules of the security token are checked to ensure the transfer meets the requirements set by the asset issuer (ownership, amount, holding period, etc.).

- Once complete, the transfer happens atomically (it is either wholly completed or wholly rejected) and instantly . If rejected, the committed assets are immediately available to the users again.

Airdrops begone!

This approach to transfers on Polymesh addresses a nagging challenge in the security token space. Longtime blockchain users are familiar with token airdrops (tokens appearing in user wallets unprompted). At first glance these unprompted drops might seem inconsequential, but it’s an ongoing regulatory concern for several reasons including AML and taxation. To put it simply, users (in particular banks and regulators) must be sure of exactly which assets they’re holding.

Polymesh addresses this problem by prompting users to accept any asset that is transferred to their wallet in order to complete a transfer . This simple and effective approach means no more surprise assets in wallets, removing a key uncertainty and roadblock for regulators and financial institutions in the way of security token adoption.

Test Polymesh on Alcyone now

Polymesh is available for testing now through the Alcyone Testnet by:

- Creating a security token and minting to the treasury through Polymesh Token Studio

- Testing anti-airdrop prompts through the Polymesh Dashboard